The Secret to Removing FHA Mortgage Insurance

If you're exploring the possibilities of an FHA loan for your home purchase, you've likely encountered the requirement for mortgage insurance. The lingering question for many borrowers is whether FHA mortgage insurance can be shed once a 20% equity threshold is reached.

Unfortunately, the answer isn't as straightforward as you would think. It actually hinges on the specifics of your down payment. For those opting for the standard 3.5% down payment, prevalent among FHA borrowers, annual mortgage insurance remains a constant for the loan's duration, even at the 20% equity mark. However, if you make a down payment of 10% or more, there's potential to cancel the annual mortgage insurance after just 11 years.

The Dynamics of FHA Mortgage Insurance

FHA home loans, under the federal government's auspices, mandate mortgage insurance. Two premiums come into play:

1. Upfront Mortgage Insurance Premium (UFMIP): A one-time fee of 1.75% of the base loan amount, can be rolled into loan payments.

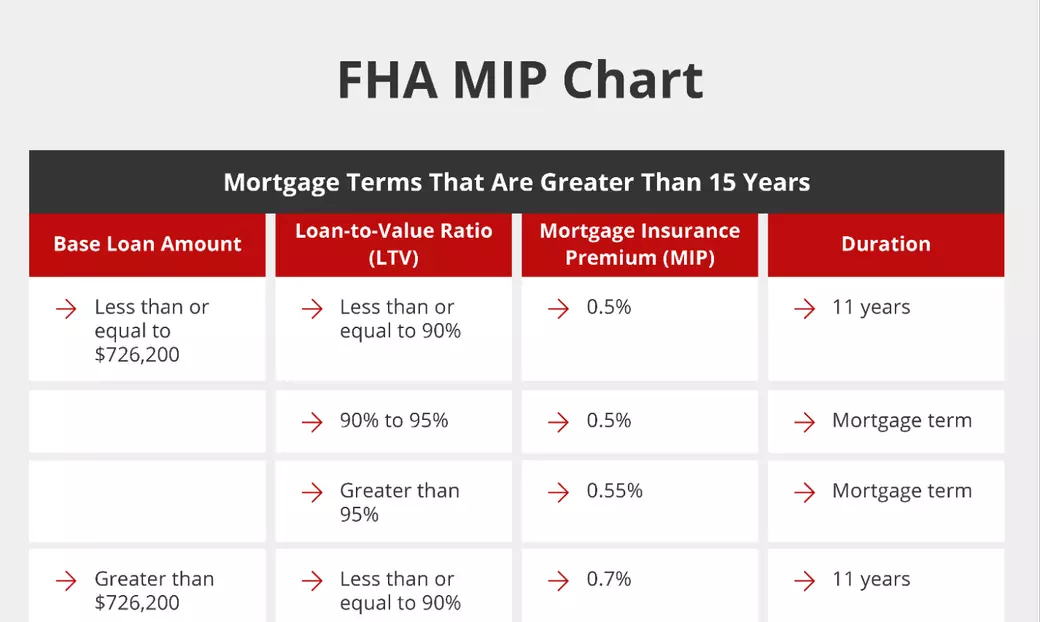

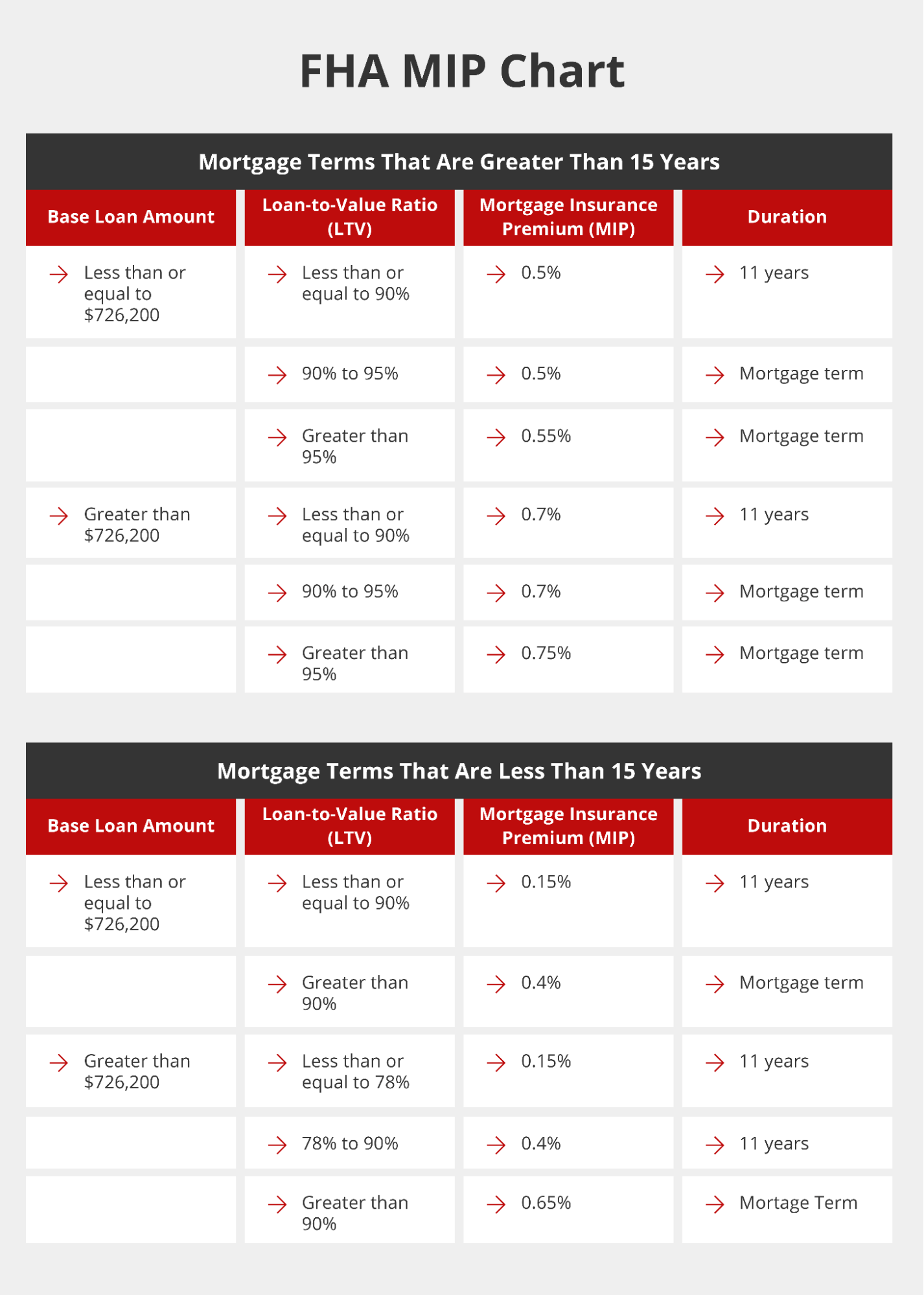

2. Annual Mortgage Insurance Premium (MIP): Typically 0.85% for 3.5% down payment borrowers.

The crucial distinction arises from the down payment amount, determining whether annual FHA mortgage insurance can be canceled after 11 years.

Down Payment and Loan-to-Value Ratio

With a down payment of 10% or more, yielding a loan-to-value (LTV) ratio of 90% or less, borrowers may enjoy the possibility of canceling annual mortgage insurance after 11 years. Conversely, down payments below 5% result in an initial LTV ratio exceeding 95%, mandating the payment of FHA annual mortgage insurance throughout the loan's life.

It's worth mentioning here, that the majority of FHA borrowers opt for down payments below 5%. In fact, this is a major attraction to using the FHA program in the first place. Since the FHA mortgage program allow for borrowers to make a down payment as low as 3.5%, this program often appeals to home buyers who have limited funds saved up for the initial upfront investment.

Because of this, most FHA borrowers make a down payment below 5%, which means they have an initial LTV ratio greater than 95%. This means that continuous payment of the annual mortgage insurance is a very common scenario. As you can see from the table above, this means they would have to pay FHA annual mortgage insurance for the life of the loan (or the “mortgage term” in industry jargon).

Understanding The 20% Equity Myth

Contrary to some conventional mortgages, where reaching 20% equity triggers Private Mortgage Insurance (PMI) removal, FHA loans operate differently. The ability to cancel FHA annual mortgage insurance revolves around the down payment size rather than achieving a specific equity level.

While homeowners with conventional mortgages can request PMI cancellation when their equity hits 80%, FHA borrowers navigate a landscape dictated by their initial down payment.

It's crucial to understand that shifting from an FHA to a conventional mortgage is a potential avenue to escape FHA annual MIP expenses. However, conventional loans might introduce their own mortgage insurance requirements as the loan-to-value ratio surpasses 80%.

For an in-depth exploration of your home-buying journey and to steer clear of common pitfalls, download our free guide, "The Ultimate Guide to Buying a Home in MD/DC/VA." Empower yourself with the right questions and insights for a seamless home purchase. Understand the nuances and make informed decisions.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "