How to Build Your Credit Score Before Buying a Home

Buying a home is one of the biggest financial decisions you'll ever make, and your credit score plays a starring role in the process. A higher score not only increases your chances of mortgage approval but can also secure you a significantly lower interest rate saving you thousands over the life of the loan.

Think of your credit score as your financial report card. Before a lender hands over hundreds of thousands of dollars, they want to see a history of responsible borrowing. If your score needs a tune-up, the time to start is now, well before you plan to submit a mortgage application.

Here is your essential guide to building a strong credit foundation for homeownership.

- Know Your Starting Point

You can't fix what you don't know. The very first step is to check your credit reports and score.

- Get Your Reports: Obtain a free copy of your credit report from each of the three major bureaus (Experian, EquiFax, and TransUnion). Look for errors like incorrect late payments or accounts that aren't yours. Dispute any mistakes immediately, as correcting them can provide an instant boost.

- Understand Your Score: While minimum score requirements vary by loan type (e.g., Conventional loans generally require 620+, FHA loans start lower), aiming for a score in the "Good" (700+) range or higher will unlock the best interest rates.

- Focus on the Fundamentals: Payment History (35% of your Score)

This is the most critical factor. Lenders want to see stability and reliability.

- Pay On Time, Every Time: This is non-negotiable. Set up automatic payments for all your debts credit cards, student loans, car loans, etc. to ensure you never miss a due date. Even a single late payment can significantly damage your score.

- Catch Up on Past Dues: If you have any overdue accounts, get current as quickly as possible. Future on-time payments will slowly heal the damage.

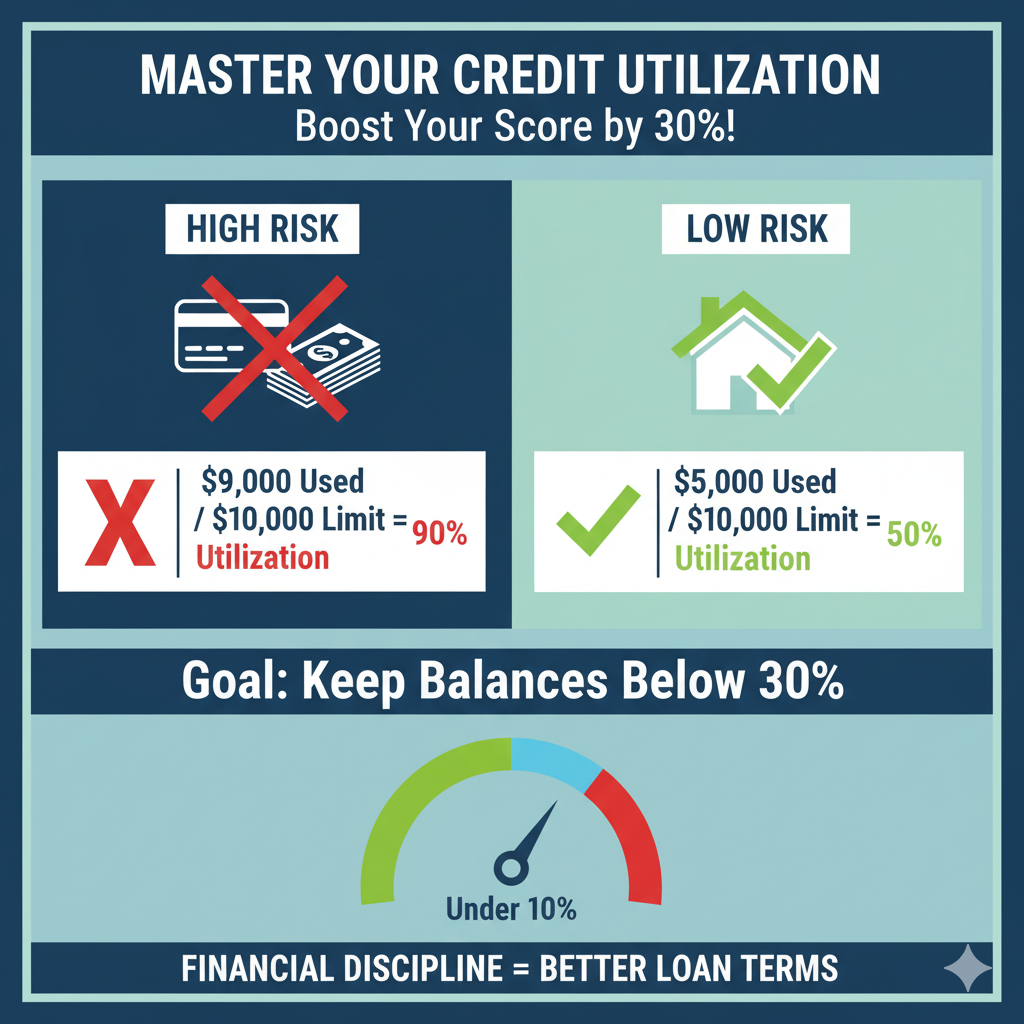

- Master Your Debt-to-Credit Ratio (30% of your Score)

This is often called your Credit Utilization Rate and measures how much of your available credit you are using. High balances signal risk.

- Keep Balances Low: The golden rule is to keep your credit utilization below 30% of your total available credit. For the best scores, aim for under 10%.

- Example: If you have a credit card with a $10,000 limit, your balance should ideally be less than $1,000 to optimize your score.

- Pay Down High-Interest Debt: Prioritize paying down your revolving credit card balances over installment loans (like car or student loans) to reduce your utilization ratio.

- Avoid Closing Old Accounts: While tempting, closing an old credit card can hurt your score by reducing your total available credit and shortening your credit history.

- Be Patient and Build Longevity (15% of your Score)

The age of your credit accounts matters. Lenders favor borrowers who have a long history of managing credit responsibly.

- Let Time Do the Work: The longer your oldest account has been open, the better. This factor is about time, so be patient and continue practicing good habits.

- Don't Close Your Oldest Card: Even if you don't use it much, keep your oldest credit card active with a small, recurring charge that you pay off every month.

- Be Strategic with New Credit (10% of your Score)

A flurry of new credit applications before a mortgage application is a red flag for lenders.

- Limit Applications: Avoid opening any new credit accounts (credit cards, store cards, or car loans) in the 6-12 months leading up to your mortgage application. Each application results in a "hard inquiry" that can cause a temporary dip in your score.

- Don't Close Accounts: As mentioned above, avoid closing existing credit lines, as this can affect both your utilization and the length of your credit history.

Bonus Tip: Get Credit for What You Already Pay

Some services allow you to report rent and utility payments to the credit bureaus, which can be an excellent way to build history, especially if you're credit-new. Research reliable services like Experian Boost (for utilities/cell/streaming) or check if your landlord reports rent payments.

Your Pre-Mortgage Credit Checklist

To summarize your preparation for a home loan, here are the key steps to take and your targets:

- Check Your Reports: Do this at least 6-12 months before applying for a mortgage to correct any errors.

- Pay Bills On Time: This is the most critical action. Ensure every payment is made by the due date.

- Reduce Balances: Keep your credit card utilization rate below 30%, and ideally under 10%, to maximize your score.

- Limit New Credit: Avoid opening any new credit accounts in the 6-12 months before applying for a mortgage.

- Maintain Old Accounts: Keep your oldest credit accounts open to ensure a long credit history.

Building a strong credit score is a marathon, not a sprint. By focusing on these core areas, you'll not only prepare yourself for mortgage approval but also position yourself to get the best possible terms on your future home loan. Start today your future self will thank you for the savings!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "