How Much House Can You Really Afford? A Buyer's Guide

Buying a home is one of the biggest financial decisions you'll ever make. It's exciting, yes, but it’s also crucial to ground that excitement in financial reality. The bank might approve you for a large loan, but that number doesn't always reflect what you can comfortably afford while still living your life. So, how do you figure out your true homebuying budget? It starts with looking beyond the sticker price and understanding the key factors lenders use, plus a few smart guidelines to keep you financially healthy.

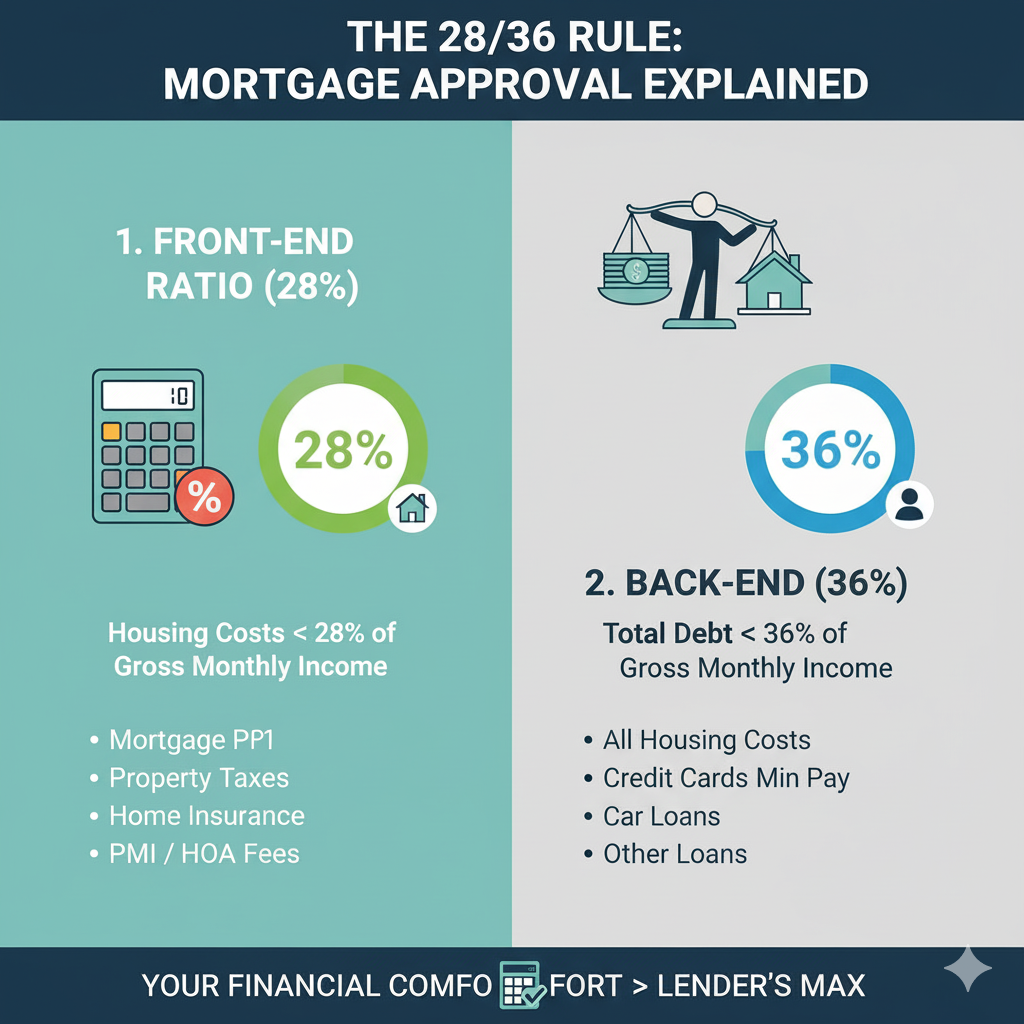

- The Lenders' Rule: The 28/36 Rule

Mortgage lenders use a standard guideline known as the 28/36 Rule to determine how much they’re willing to lend you. This rule is based on your gross monthly income (your income before taxes and deductions). The Front-End Ratio (28%) This part of the rule states that your total monthly housing expenses should not exceed 28% of your gross monthly income.

- Housing expenses typically include:

- Principal and Interest (P&I) on the mortgage.

- Property Taxes.

- Homeowner's Insurance.

- Private Mortgage Insurance (PMI, if your down payment is less than 20%).

- Homeowners Association (HOA) fees (if applicable).

The Back-End Ratio (36%) This is also known as your Debt-to-Income (DTI) ratio. It states that your total monthly debt payments including all your housing costs plus any other recurring debts should not exceed 36% of your gross monthly income.

- Total debts include:

- All monthly housing expenses (from the 28% calculation).

- Credit card minimum payments.

- Car loans.

- Student loans.

- Alimony or child support.

The Reality: While 36% is the classic guideline, many lenders will approve you with a higher DTI, sometimes up to 43% or even 50% for certain loan types. However, just because a lender will give you a bigger loan doesn't mean you should take it! This is the point where you need to check in with your personal comfort level, especially since housing costs and property taxes can vary significantly between regions like Montgomery County versus Prince George's or Charles counties.

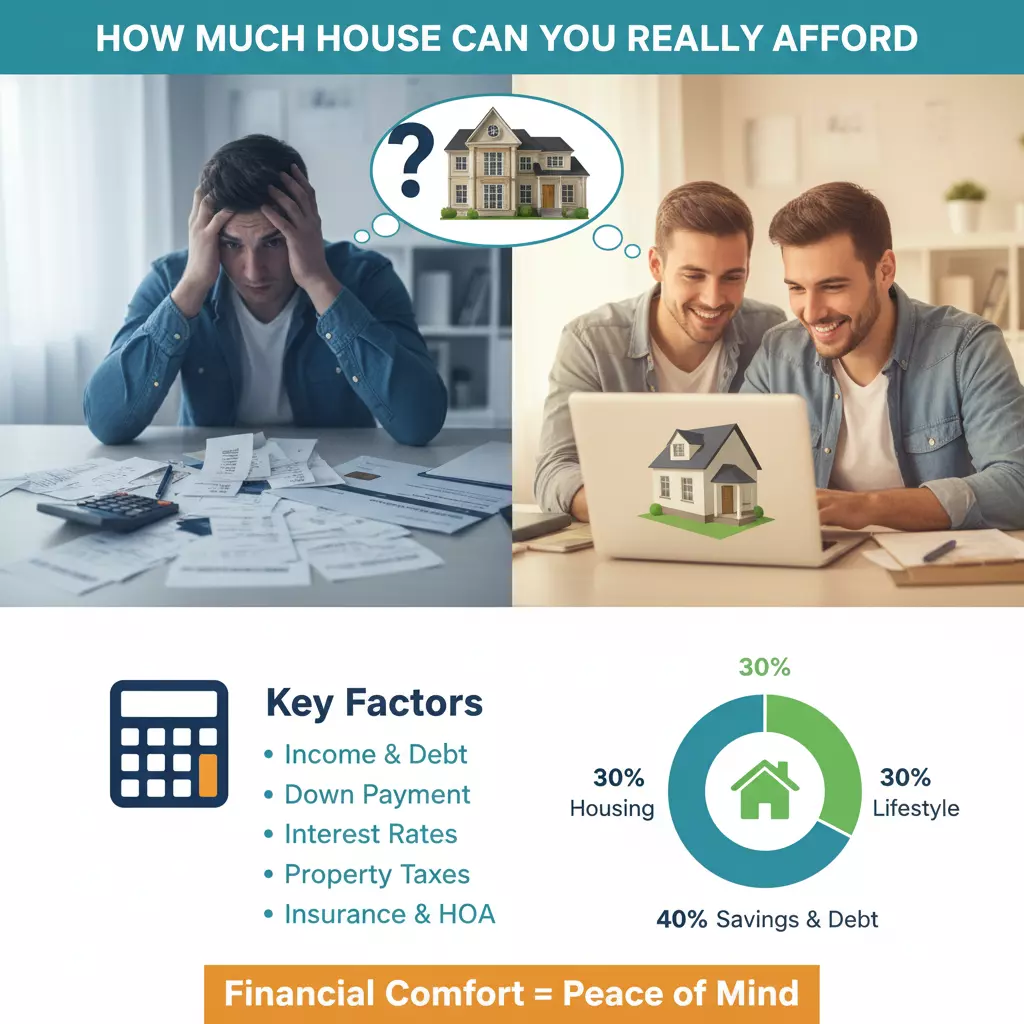

- The Personal Check-In: Your Lifestyle

The biggest mistake buyers make is becoming "house poor" owning a great house but having no money left over for life. The 28/36 rule is a good start, but it doesn't account for your specific spending habits or financial goals. Beyond the Mortgage Take a hard look at all the expenses that aren't included in the lender's DTI calculation:

- Groceries and Dining Out: A higher mortgage payment might mean cutting back on your favorite weekly takeout.

- Childcare and Education: These costs are significant and non-negotiable for many families.

- Savings and Retirement: Over-committing a mortgage can derail long-term savings goals.

- Entertainment and Travel: Do you want to take a vacation every year? Factor that in!

If a higher monthly payment leaves you with virtually no discretionary income, you're likely overextending yourself. For example, managing a large mortgage in high-cost areas like Montgomery County often requires stricter budgeting for dining and entertainment than buyers might face in Charles County. Try to find a comfortable monthly payment first, then work backward to the affordable home price.

- The Hidden Costs: Upfront and Ongoing

An affordable house isn't just about the monthly payment; it's also about the significant lump-sum payments and new recurring expenses that come with ownership. Upfront Costs

- Down Payment: This is typically 3% to 20% of the home's purchase price. Aiming for 20% helps you avoid Private Mortgage Insurance (PMI).

- Closing Costs: These are fees associated with finalizing your mortgage and typically range from 2% to 5% of the loan amount. This includes appraisal fees, title insurance, lender origination fees, and more.

- Moving and Initial Setup: Budget for movers, new furniture, repairs you want to make immediately, and utility hookups.

Ongoing Homeowner Costs When budgeting, remember that property tax rates vary significantly. A comparable home in Prince George's County might have a different tax burden than one in Montgomery County, directly impacting your total monthly housing cost.

- Maintenance and Repairs: Experts recommend setting aside 1% to 3% of the home's value annually for maintenance. Old homes cost more; new homes still need upkeep. This is not included in your PITI payment.

- Higher Utilities: A bigger house often means bigger utility bills. Get estimates from the current owners!

- Your Financial Fitness Score

Before you even start house hunting, you need to get your personal finances in order. Boost Your Credit Score Your credit score directly affects your mortgage interest rate. A higher score can save you tens of thousands of dollars over the life of the loan, significantly lowering your overall monthly payment and increasing what you can afford. Reduce Existing Debt Lowering your existing monthly debt payments will drastically improve your DTI ratio, which could qualify you for a larger mortgage and, more importantly, free up more of your income for the actual home. Save for Reserves Lenders like to see that you have cash reserves money left in the bank after your down payment and closing costs. This proves you can handle unexpected expenses and are less likely to default on the loan. Aim to have enough to cover at least three to six months of future mortgage payments.

Your Action Plan: Get pre-approved

Ultimately, the best way to know how much house you can afford is to speak with a mortgage lender and get pre-approved.

- Gather Documents: Collect pay stubs, W-2s, bank statements, and information on all your debts.

- Meet with a Lender: They will review your credit and finances and give you a formal pre-approval letter stating the maximum loan amount you qualify for.

- Adjust the Number: Take the lender's maximum number, apply the 28/36 rule yourself, and then subtract your other lifestyle costs and maintenance budget. The resulting number is the price range you can truly afford.

The right home is the one that fits your dreams and your budget. Don't let a huge pre-approval number tempt you into a life of financial stress. Be smart, be realistic, and happy house hunting!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "