Buying a Home in a Buyer’s vs. Seller’s Market: What’s the Difference?

The real estate market seems to speak a language of its own. You constantly hear terms like "hot market" or "slump," but when you’re ready to buy, the most crucial distinction is whether you are entering a Buyer’s Market or a Seller’s Market. Understanding which one you're in isn't just trivia, it dictates your strategy, your negotiation power, and ultimately, how much you pay for your new home.

Here is a breakdown of the key differences and what each market means for you, the homebuyer.

The Seller’s Market: Fast Paces and High Prices

In a Seller’s Market, demand for homes far exceeds the supply of houses on the market. This is what people often call a "hot market" or an "aggressive market." In these conditions, for example, homes listed in Bowie might fly off the market within a weekend, often attracting multiple bids.

What It Looks Like:

- Low Inventory: There are simply not enough homes to go around.

- Rapid Sales: Homes often sell days after listing, sometimes before the first open house.

- Escalating Prices: Properties often sell for well above the asking price.

- Multiple Offers: Buyers compete against several other offers, leading to bidding wars.

What it Means for the Buyer:

When navigating a Seller's Market, you must adjust your strategy to compete:

- Speed is Critical: You must be pre-approved for a mortgage and ready to make an offer immediately. Hesitation means losing the house.

- Limited Negotiation: You have little to no negotiating power. Expect to pay the asking price or higher.

- Contingency Compromise: Sellers prefer offers with few or no contingencies (like waiving the home inspection or appraisal contingency), which increases your risk.

- Competitive Offers: You may need to offer an "escalation clause" (automatically increasing your offer above competing bids up to a set maximum) or a significant amount of earnest money.

- High Stress: The process is often frustrating, competitive, and emotionally taxing.

The Bottom Line: In a Seller’s Market, you need to be decisive, financially strong, and prepared to compromise on your ideal terms to secure a property.

The Buyer’s Market: Opportunity and Power

A Buyer’s Market occurs when the supply of homes for sale is greater than the demand from buyers. This is often referred to as a "cold market" or a "slow market." In these conditions, for instance, a large selection of available homes in Upper Marlboro might sit on the market for weeks or months, giving buyers ample choice.

What It Looks Like:

High Inventory: Many listings are available, giving you plenty of options.

- Longer Shelf Life: Homes stay on the market for weeks or even months.

- Stagnant or Falling Prices: Sellers may reduce their asking price after a period with no offers.

- Few Competing Offers: You are likely the only one or one of a few submitting an offer.

What it Means for the Buyer:

In a Buyer's Market, you gain leverage and opportunity:

- Time to Explore: You have time to shop around, compare listings, and carefully consider your options.

- Significant Negotiation: You have strong leverage. You can negotiate on price, closing costs, and repairs.

- Contingency Confidence: You can confidently include necessary contingencies, like a thorough home inspection and appraisal, to protect your investment.

- Favorable Terms: You can start below the asking price. It’s also a great time to ask the seller to pay a portion of your closing costs.

- Lower Stress: The process is calmer, and you can take a more methodical approach.

The Bottom Line: In a Buyer’s Market, you can take your time, be selective, and use your negotiating power to secure the best deal and terms possible.

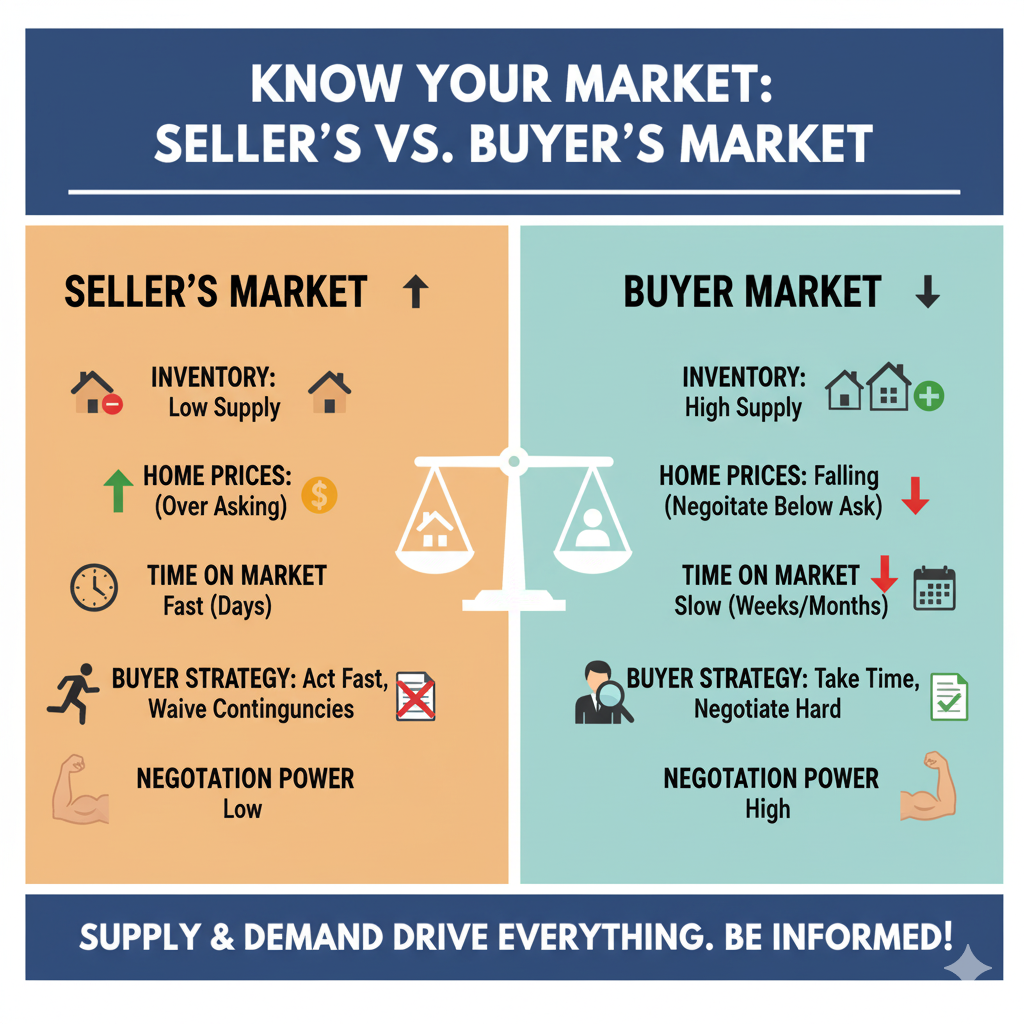

Summary: Know Your Market Before You Search

The core differences between a Seller's Market and a Buyer's Market boil down to a few key factors:

- Inventory: A Seller’s Market (like Bowie during a boom) is characterized by a low supply of homes, while a Buyer’s Market (like Upper Marlboro during a slowdown) has a high supply.

- Home Prices: In a Seller's Market, prices are rising, and homes often sell over the asking price. Conversely, in a Buyer's Market, prices are stagnant or falling, offering more room for negotiation.

- Time on Market: Homes sell quickly (in days) in a Seller's Market, but they stay on the market longer (weeks or months) in a Buyer's Market.

- Buyer Strategy: In a Seller's Market, you need to act fast, waive contingencies, and offer high. In a Buyer's Market, you should take your time, negotiate hard, and demand contingencies.

- Negotiation Power: Your power is low in a Seller’s Market, but high in a Buyer’s Market.

Before you start your home search, talk to your real estate agent. They can tell you exactly which market conditions apply to your desired neighborhood. This knowledge is your most powerful tool, allowing you to tailor your strategy whether it’s to pounce immediately or to patiently wait for the perfect deal.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "