From Offer to Closing: What Sellers Should Expect

Selling your home is a marathon, not a sprint. Receiving a great offer is a huge milestone, but it's only the start of a complex process that takes roughly 30 to 60 days. The journey from a signed contract to the money hitting your bank account involves inspections, appraisals, and legal clearances.

Understanding what comes next will help you stay calm, organized, and ready to navigate potential hurdles. Here is a timeline of the key stages you should expect after accepting an offer.

Stage 1: Contract Execution and Deposit (Days 1–3)

Once you've accepted a buyer's offer, the contract is officially "executed." This short phase establishes the deal's foundation.

- The Earnest Money Deposit (EMD): The buyer is required to submit a good-faith deposit (the EMD). This money is held in an escrow account by a third party (like a title company or attorney) and serves as the buyer's promise. In competitive markets like Washington, D.C., the EMD is often substantial to make the offer more attractive.

- Opening Escrow/Title: Your agent opens the file with the chosen escrow or title company. They will begin the crucial work of ensuring the property can be legally transferred and that your existing mortgage will be paid off.

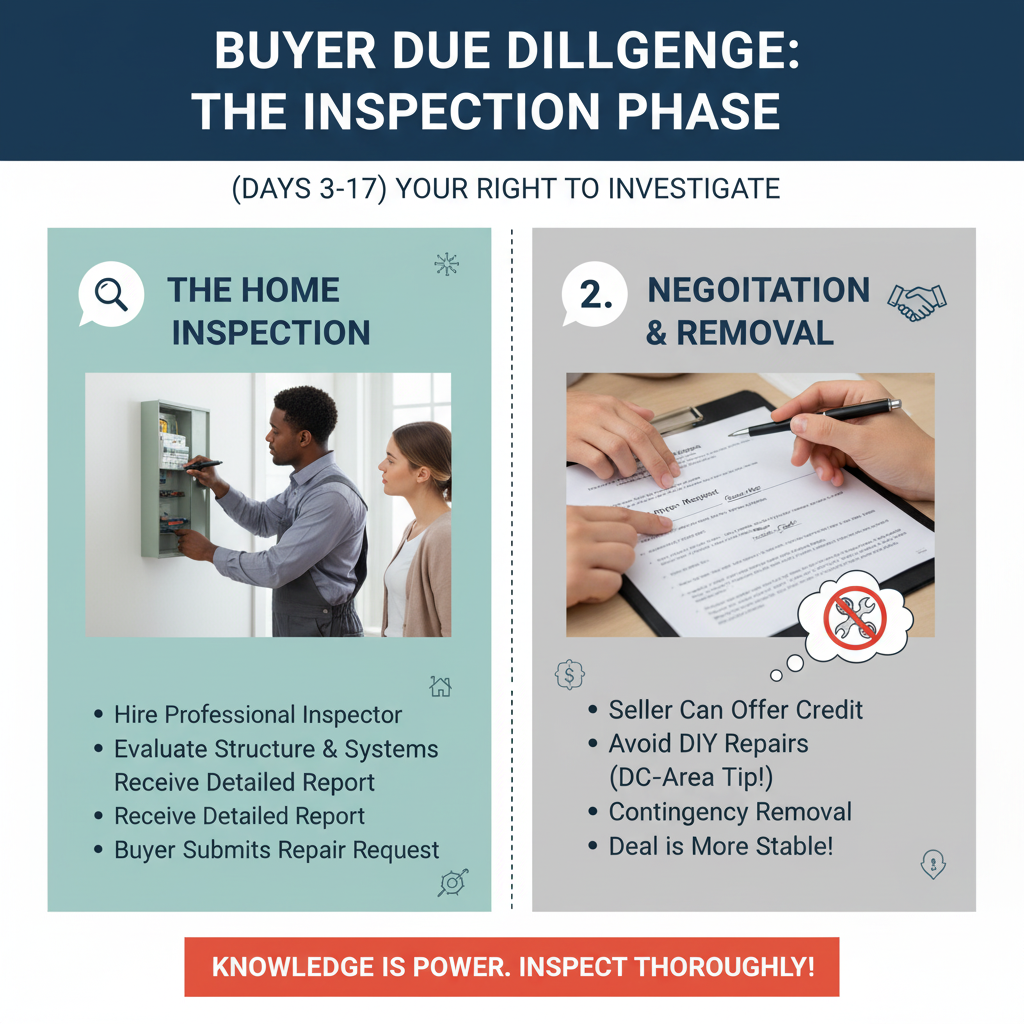

Stage 2: Buyer Due Diligence (Days 3–17)

This is the most intense period, where the buyer exercises their right to ensure the home is exactly what they agreed to buy.

- The Home Inspection: The buyer hires a professional inspector to evaluate the home's structure, systems, and condition. You must grant access. The buyer will then submit a Repair Request based on the findings.

- Seller's Response: Do not panic. You are not obligated to agree to every request. Work with your agent to offer a fair seller credit instead of doing the repairs yourself. The credit is cleaner and faster than managing contractors, a particularly valuable tip when dealing with the high cost and complexity of contractor work in Washington, D.C.

- Contingency Removal: Once the buyer is satisfied with the inspection results, they will formally remove the inspection contingency. This is a major step forward, dramatically increasing the deal’s stability.

Stage 3: Lender and Appraisal Hurdles (Days 10–30)

If the buyer is using a loan (which most are), the lender takes over the process to protect their investment.

- The Appraisal: The buyer’s lender hires an appraiser to determine the property's fair market value. The lender will typically not finance more than the appraised value.

- The Appraisal Gap: If the appraisal comes in lower than the agreed-upon sale price, you have a problem. Your agent will negotiate with the buyer to see if they will cover the "gap" in cash, or you may need to reduce the price. This gap is a common issue when bidding wars push sale prices high in high-demand D.C. neighborhoods.

- Title Search: The title company conducts a search to ensure there are no liens, encumbrances, or disputes against the property that could prevent you from transferring a "clean" title to the buyer.

Stage 4: Final Approval and Closing Prep (Days 30–55)

The finish line is in sight, but key legal and financial checks remain.

- Loan Underwriting: The buyer's lender completes their deep review of the buyer’s finances. Once they are satisfied, they issue the Clear to Close (CTC) the final green light.

- Final Walk-Through: Just before closing, the buyer conducts a final inspection to confirm that the property is in the same condition as when they made the offer, and that any agreed-upon repairs have been completed.

- Documentation: You will receive a Closing Disclosure (CD) outlining all financial details, including the final payment of your existing mortgage, property taxes, and the net proceeds you will receive. Review this document carefully with your agent.

Stage 5: The Closing Day (Day 60)

This is the final transfer of ownership and funds. Depending on your state, you may meet the buyer, or you may sign documents separately at the title company or attorney's office. In the District of Columbia, the closing is typically handled by a title attorney.

- Signing: You will sign the Deed transferring the property, as well as various affidavits and final closing statements.

- Disbursement: Once all documents are signed and the buyer's funds are wired, the deal is recorded, and the title company disburses the funds. Your old loan is paid off, commissions are paid to agents, and the remaining net proceeds are wired directly to you.

- Key Exchange: The keys are officially handed over to the new owner, and you are done!

The waiting period can be stressful, but by knowing these milestones and working closely with your agent to anticipate challenges (especially with the inspection and appraisal), you can navigate the process smoothly and successfully.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "