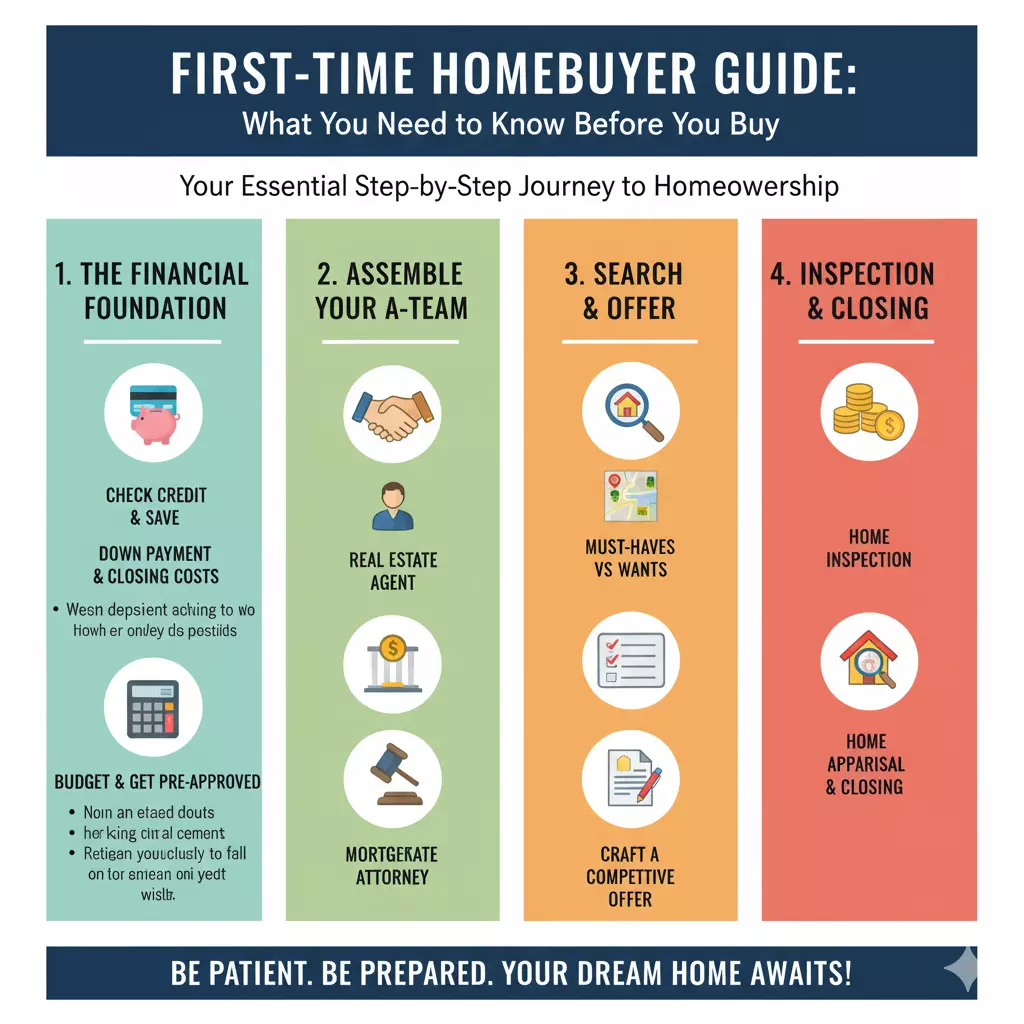

First-Time Homebuyer Guide: What You Need to Know Before You Buy

Buying your first home is a monumental milestone exciting, a little nerve-wracking, and one of the biggest financial decisions you'll ever make. The path to homeownership can feel overwhelming, but with the right knowledge and preparation, you can navigate it with confidence. This guide will walk you through the essential steps you need to take before you even start house hunting.

- The Financial Foundation: Getting Your House in Order

Before you fall in love with a charming bungalow or a sleek condo, you need to understand your financial standing. This is the most critical first step.

- Check Your Credit Score: Your credit score is a major factor in determining your mortgage interest rate and eligibility. Lenders use it to assess their reliability as a borrower. Get a free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) and check for any errors. Aim for a score of 740 or higher to get the most favorable rates.

- Save for Down Payment and Closing Costs: The bigger your down payment, the lower your monthly mortgage payments will be. While 20% is the traditional benchmark to avoid private mortgage insurance (PMI), many loans (like FHA and some conventional loans) allow for much lower down payments. However, don't forget about closing costs these are the fees associated with the home purchase, typically 2% to 5% of the loan amount.

- Determine Your Budget (and Get Pre-Approved): This is where you figure out what you can realistically afford. A good rule of thumb is the 28/36 rule: your housing expenses (mortgage, property taxes, and insurance) should not exceed 28% of your gross monthly income, and your total debt payments (including housing) should not exceed 36%.

-

- Get Pre-Approved, Not Just Pre-Qualified: Pre-qualification is a quick estimate of what you might be able to borrow. Pre-approval is a more thorough process where a lender verifies your financial information and formally agrees to lend you a specific amount. This makes you a more serious and attractive buyer in a competitive market.

- The Right Team: Assembling Your A-Team

You don't have to go through this process alone. Building a team of trusted professionals is key to a smooth transaction.

- Find a Real Estate Agent: A great agent is your advocate and guide. They understand the local market, can help you find suitable properties, negotiate on your behalf, and walk you through the complex paperwork. Interview a few agents to find one you click with and who has a strong track record of working with first-time buyers.

- Choose a Lender: You can work with a traditional bank, a credit union, or a mortgage broker. A mortgage broker can shop around for the best rates from multiple lenders for you. Compare interest rates, fees, and the types of loans they offer.

- Get a Real Estate Attorney (in some states): In some states, a real estate attorney is required to review contracts and close the deal. Even if it's not a requirement, an attorney can be an asset for legal counsel and to protect your interests

- The Search & The Offer: What to Look for and How to Make a Move

Now for the fun part! But don't let the excitement cloud your judgment.

- Create a "Must-Haves" vs. "Nice-to-Haves" List: Be realistic about what you need versus what you want. Do you need a certain number of bedrooms? Is a big backyard non-negotiable? Differentiating these will help you focus your search and avoid getting sidetracked by properties that don't meet your fundamental needs.

- Location, Location, Location: This classic real estate mantra is true for a reason. Consider the neighborhood's schools, commute times, local amenities, and future development plans. A good location will protect your investment in the long run.

- The Offer and Negotiation: Your real estate agent will help you craft a competitive offer. The offer will include the price, a down payment, a closing date, and any contingencies (like a home inspection or appraisal). Be prepared for some back-and-forth negotiation.

- The Home Stretch: Inspection and Appraisal

Once your offer is accepted, the real work begins.

- The Home Inspection: This is your chance to get a professional to evaluate the home's condition. The inspector will check everything from the roof to the foundation, looking for potential issues. The inspection can reveal hidden problems and give you a chance to negotiate with the seller for repairs or credit. Never skip this step.

- The Appraisal: An appraisal is an objective professional opinion of the home's value. Your lender requires this to ensure the property is worth at least the amount of the loan. If the appraisal comes in lower than the offer price, you and your agent will need to renegotiate with the seller.

Final Thoughts: Be Patient and Persistent

The homebuying process is a marathon, not a sprint. There will be highs and lows, and you may face rejection or unexpected challenges. Stay patient, trust your team of professionals, and stick to your budget. The feeling of getting the keys to your very own home will make every step of the journey worth it.

Happy house hunting!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "